In my 2020 Annual Report to Congress (ARC), I discussed the unnecessary delays and difficulties taxpayers encounter reaching an accountable and knowledgeable IRS employee for assistance with correspondence audits. More than 70 percent of the audits conducted by the IRS are correspondence audits, making this audit type one of the most significant tools the IRS employs to pursue compliance with tax laws. The taxpayer’s ability to interact and communicate with the IRS is crucial to the success of the correspondence audit process and the taxpayer’s IRS experience. While the IRS is developing new online tools to interact electronically with taxpayers, it must simultaneously ensure taxpayers can successfully navigate these tools while continuing to provide live customer assistance to those who request it.

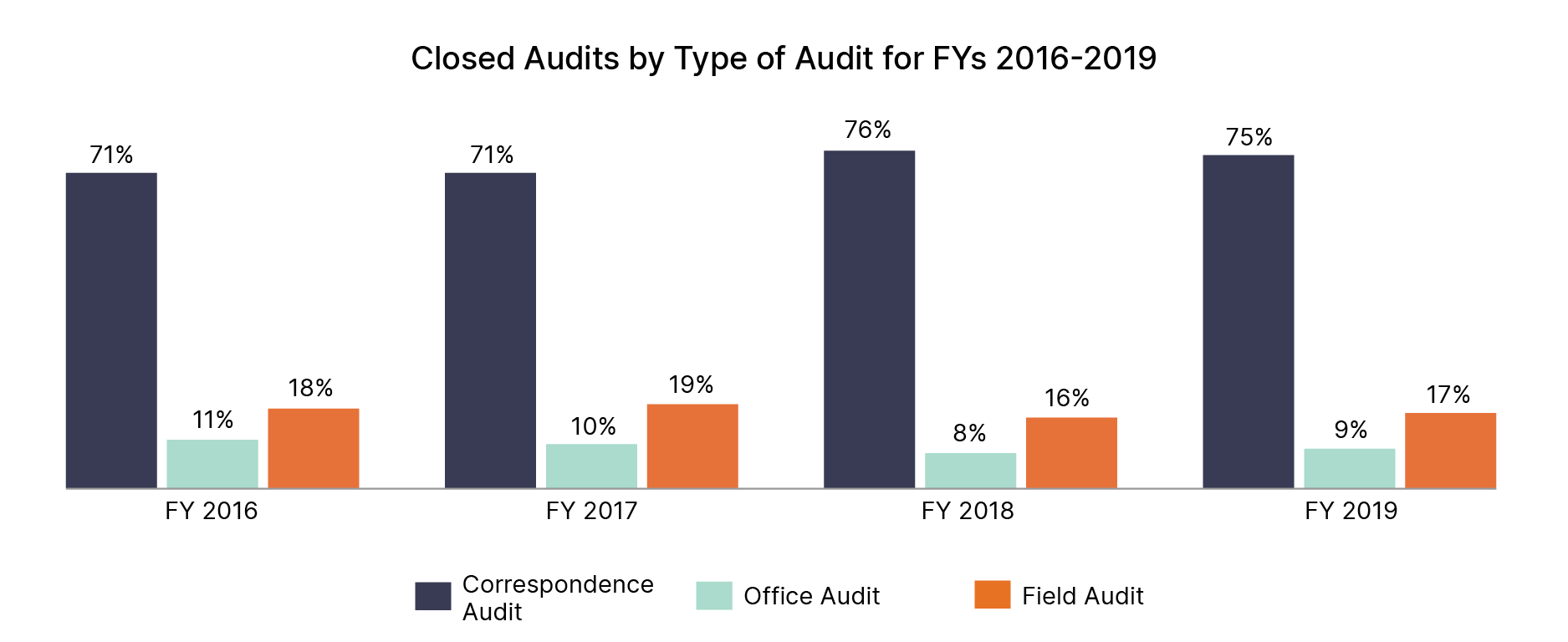

Correspondence audits are tax examinations conducted by mail for a single tax year involving no more than a few issues that the IRS anticipates it can resolve and close by reviewing relevant documents. Because these audits are limited in scope, the volume of these audits far exceeds any other type of audit conducted by the IRS. As depicted in the graph below, the overwhelming majority of IRS examinations are conducted through correspondence audits.

Some of the highest volume issues addressed by correspondence audits during fiscal year (FY) 2019 included the Earned Income Tax Credit (EITC); employee business expenses; nonfilers; items related to Schedule C, Profit or Loss from Business (Sole Proprietorship); and questionable refunds. While these issues may at first glance seem simple, many of these audit categories can encompass complicated rules, procedures, or factual situations that could give rise to taxpayer questions, the need for assistance, and the need to communicate with an IRS examiner.

Taxpayers receiving correspondence audit notifications should read the letters carefully and follow the instructions. All documentation requested should be submitted to the IRS by the due date in the letter, or the taxpayer should contact the IRS and request additional time. Ignoring the IRS is typically not a good strategy. If the IRS does not receive a response by the due date, it will not make a second contact. If the IRS does not receive a response, it will generally disallow the item(s) claimed and ultimately issue a Notice of Deficiency in accordance with IRC § 6212. A Notice of Deficiency is a legal notice that the IRS is proposing an additional deficiency (balance due). It provides taxpayers 90 days to petition the United States Tax Court for review (150 days if addressed to a person outside the United States). If no petition is filed, the IRS has the legal authority to assess and collect the proposed deficiency. After the assessment, a notice will be sent advising of the tax account adjustments, explaining any balance due, and requesting payment. If full payment or payment arrangements are not made within the timeframe on the notice, collection notices will be issued, and subsequent collection action may commence. The first collection notice is referred to as the CP 501, Individual (IMF) Balance Due – First Notice. It is wise to address any balance due as quickly as possible to avoid additional penalties, interest, or collection actions that could occur if the balance due remains unresolved.

Right to Retain Representation

Taxpayers have the right to retain representation during IRS audits. You may choose to obtain professional assistance (from an attorney, certified public accountant, enrolled agent, or tax professional). Taxpayers may also qualify for free or low-cost assistance from a Low Income Taxpayer Clinic (LITC). LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. LITCs can also help taxpayers respond to IRS notices and correct account problems. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language.

Best Practices

When responding to the IRS, we recommend you do not send original documents – send copies. When submitting documents, you should include your name, taxpayer identification number (Social Security number or individual taxpayer identification number) and the tax year involved on each page. This helps the IRS associate all documents with your IRS’s file. You can contact the number provided on the IRS notice if clarification is needed, and always retain copies of any correspondence received from, or submitted to, the IRS. Along with your documentation consider providing written statements to support the items under examination. In many cases, statements or use of an affidavit similar to testimony during a trial can be used to corroborate a credit, deduction, or item of income. Also, there may be alternative documents that can support the item at issue that aren’t listed on the IRS’s original request. Taxpayers should consider reaching out to a tax professional, such as an LITC, for assistance in responding to IRS inquiries. Usually, there is more than one way to approach supporting an item at issue to establish your entitlement to the deduction or credit. Taxpayers should not be constrained by only answering the IRS’s inquiries, as taxpayers may have additional information or documents that will support items on the return.

Communication is key during an examination. Do not disregard IRS notices or deadlines. If a taxpayer cannot timely respond, it is imperative that the taxpayer contact the IRS and request additional time. Disregarding the IRS is not a good practice.

Upon review of the documents submitted, the IRS can agree and close the matter or issue an examination report reflecting any proposed adjustments to the return under audit. A word of caution: Taxpayers should not sign an audit report if they do not agree with or understand the IRS’s proposed adjustments. Instead, they should respond by the due date sending additional documentation or further explanation, request an informal conference with the examiner’s manager, or request a conference with the IRS Independent Office of Appeals (Appeals). Requests for a conference with Appeals, referred to as a protest, must be made in writing and include the reasons for disagreeing with the IRS’s proposed adjustments. Information on the correspondence audit process and how to file a protest can be found in IRS Publication 3498-A, The Examination Process (Audits by Mail).

Unlike other IRS audits, correspondence audits are not assigned to a single examiner who oversees the entirety of the audit. These taxpayers are referred to Wage and Investment (W&I) and Small Business and Self Employed (SB/SE) correspondence audit toll-free phone numbers that operate with high hold times and provide limited levels of service. TAS continues to advocate for a single point of contact for all correspondence audits. We contend the inability to reach a single point of contact diminishes the customer experience, creates IRS inefficiency, hinders opportunities to engage and educate our nation’s taxpayers, and decreases potential for developing and building trust with the IRS. COVID-19 further exacerbated the IRS’s correspondence audit communication-related shortcomings. As a part of its People First Initiative, the IRS generally didn’t start new audits from April 1, 2020 through July 15, 2020, and open correspondence audits were largely brought to a standstill due to technology and communication limitations. Correspondence audit toll-free phone assistance was suspended from March through September of 2020, while over 90 percent of the IRS’s correspondence was ultimately classified as overage – meaning the IRS was not able to provide a response to the taxpayer within 30 days. In some instances, taxpayers received interim letters requesting they allow up to six months before receiving an IRS reply.

As of July 29, 2021, the IRS still hadn’t resolved 94,313 correspondence audits related to tax year 2019. Nearly 32,860 of these audits relate to returns claiming the EITC, which is vital for so many taxpayers. Similarly, 2,907 audit reconsiderations of prior year returns remain unresolved. Resolving these audit reconsiderations is especially significant, because as long as an unresolved balance due exists, the IRS may offset a refund to apply to it.

To combat some of the correspondence audit communication difficulties discussed, the IRS developed a communication alternative through the Secure Messaging feature of its Taxpayer Digital Communications (TDC) program. Initially launched in the Philadelphia campus, SB/SE has now expanded the use of TDC to all 5 of its campuses. This initiative offers certain taxpayers and their representatives the ability to communicate electronically with the IRS during their audit. TDC Secure Messaging enables taxpayers to receive messages from the IRS, respond to questions, upload documents using the IRS’s Secure Messaging Portal, and work with one IRS employee to resolve the audit. Taxpayers invited to participate in this program must authenticate their identities via IRS Secure Access, which starts the process and ultimately enables them to log into the TDC Secure Messaging Portal to engage in two-way communication.

TDC Secure Messaging is currently only available to those who receive and accept an IRS invitation to participate and who subsequently pass the strict authentication requirements necessary to screen out hackers and other unauthorized persons. The process requires verification of information from a taxpayer’s credit history to authenticate the taxpayer’s identity. For transient taxpayers and those unable to access prior financial records, accessing this suite of online services can be a challenge. For eligible taxpayers and those able to access it, TDC Secure Messaging offers a more expedient communication alternative to traditional mail and enables taxpayers to access other IRS online services such as e-Services and Get Transcripts using the same account login name and password.

Additional good news: Later this month, the IRS is rolling out its use of the Document Upload Tool (DUT) for correspondence audits. The DUT platform allows taxpayers to upload documents requested during the correspondence examination instead of having to mail or fax documentation – which is a welcome tool in light of the current paper challenges using mail. Taxpayers will only need access to a smartphone or their computer to utilize the tool. It allows taxpayers to upload documents in real time, allowing an IRS employee to discuss the documents with the taxpayers. If a taxpayer has an open correspondence examination audit, he or she should inquire with the examination telephone assistors to determine it the tool is available for their case.

We anxiously await other, more robust online options in the future that will expedite examinations.

For those taxpayers able to authenticate, TDC Secure Messaging shows potential for improving taxpayers’ correspondence audit experience as well as the correspondence audit process itself. The IRS indicates that using TDC Secure Messaging has resulted in a reduction in time needed for audit completion and produced significant increases to customer satisfaction. The IRS reported customer satisfaction rates consistently ranging near 83 percent among those taxpayers using TDC Secure Messaging. The use of the DUT tool is another step towards improving the audit process and I continue to ask the IRS to expand and improve its digital service offerings so that all interested taxpayers may resolve account matters in this efficient manner, thus freeing up more employees to respond to taxpayers’ telephone inquiries. While I continue to advocate for a single point of contact for correspondence audits, TDC and similar online engagement tools can benefit many taxpayers working with the IRS to resolve their correspondence audits. TDC is a communication tool that taxpayers should consider if offered the opportunity.

The views expressed in this blog are solely those of the National Taxpayer Advocate. The National Taxpayer Advocate presents an independent taxpayer perspective that does not necessarily reflect the position of the IRS, the Treasury Department, or the Office of Management and Budget. NTA Blog posts are generally not updated after publication. Posts are accurate as of the original publication date.