Over the last year, the IRS has added new features and tools to Individual Online Account that can help taxpayers during this filing season. You should consider signing up for your IRS online account as you prepare to file your tax return.

Why wait on hold when you have faster options? Filing season is the busiest season for the IRS, with calls to IRS customer service lines reaching the highest volumes seen all year. With an online account, you may find the information you need any time without having to call the IRS. Currently, once you sign up for an online account, you can:

The IRS is continuously adding new functionality and features to online accounts.

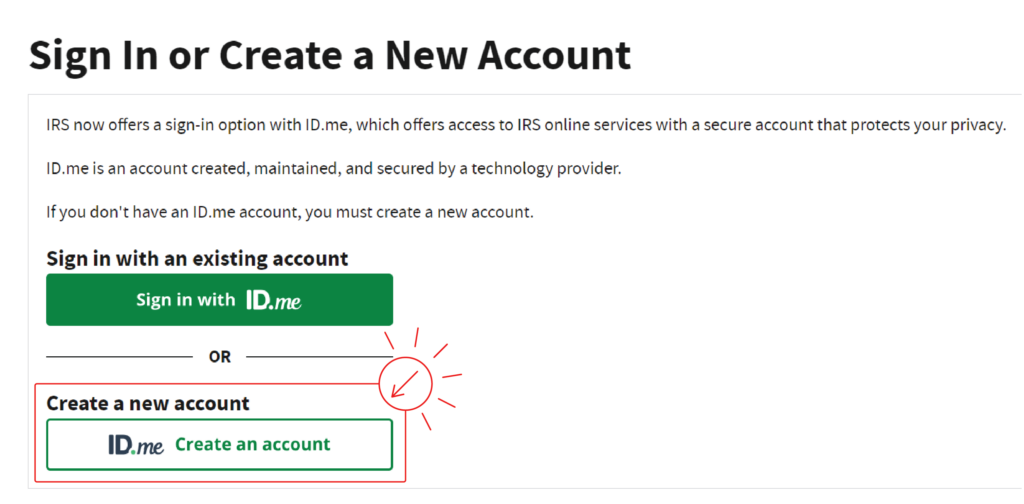

It’s easy to sign up for an online account. Visit the Your Online Account page and click the Sign in to your Online Account button.

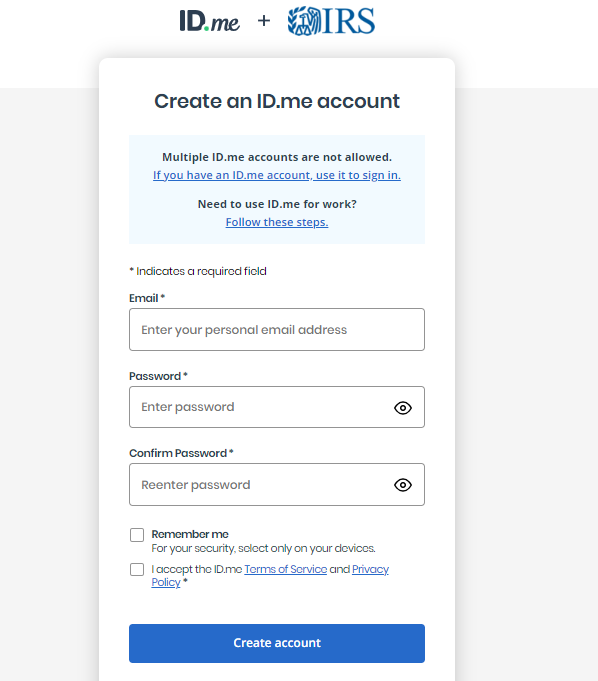

Select Create an Account to begin the identity verification process, which is facilitated by a technology provider, ID.me.

This self-service identity verification process involves uploading personal identification, taking a video selfie, and providing other personal identifying information, a process that typically takes five to ten minutes. Or, if you prefer, you can verify your identity with a live video call with an ID.me agent. This option also typically takes five to ten minutes to complete, in addition to your hold time for an available agent. If you prefer to verify your identity with a video call but don’t wait to wait on hold, you can schedule an appointment for a day and time that works for you. Visit the ID.me Help Center for more information.

Stay tuned for an upcoming blog post where I will discuss how to use your online account to find your adjusted gross income, view notices, and read your transcript.

The views expressed in this blog are solely those of the National Taxpayer Advocate. The National Taxpayer Advocate presents an independent taxpayer perspective that does not necessarily reflect the position of the IRS, the Treasury Department, or the Office of Management and Budget. NTA Blog posts are generally not updated after publication. Posts are accurate as of the original publication date.