Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Erin M. Collins. Additional blogs can be found at www.taxpayeradvocate.irs.gov/blog.

In an earlier blog I discussed my concern about how the IRS’s private debt collection (PDC) program affects taxpayers who are likely experiencing economic hardship. In this blog, I want to share my concern that the IRS is not making good business decisions as it implements the PDC initiative.

Since 2004, Internal Revenue Code (IRC) § 6306 has authorized the IRS to outsource tax debts to private collection agencies (PCAs). The IRS can pay the PCAs a fee of up to 25 percent of the amount they collect and the IRS itself is permitted to retain up to 25 percent of the amount PCAs collect. In 2015, Congress amended IRC § 6306 to require the IRS to assign “inactive tax receivables” to PCAs. The statute doesn’t require the IRS to assign recent assessments to PCAs, but if the taxpayer already has a debt assigned to the PCA, any new assessments will also be assigned. Here’s an example of how the process will work:

The taxpayer’s 2016 liability in this example would not be an “inactive tax receivable,” so the IRS is not required by IRC § 6306 to assign it to a PCA, but it will exercise its discretion to do so.

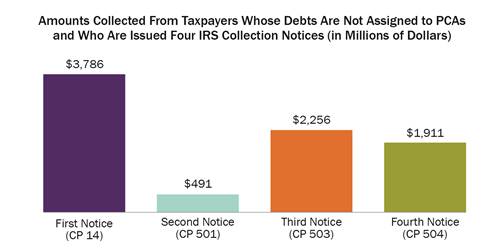

Assigning the recent assessment to PCAs means the taxpayer will not get the usual IRS demands for payment, a process which takes place over about six months and consists of a series of four notices. IRS Notice CP 14 is the first such notice, and is the only notice the IRS intends to issue in the example. In Fiscal Year 2016, the Notice CP 14 resulted in $3.8 billion of payments. Notices generated after the CP 14, however, resulted in $4.7 billion of payments. The IRS plans to suppress those notices, allow the PCAs to solicit payments that might have been made in response to them, and pay the PCAs a commission on the amounts collected. Here is a chart showing the amounts the IRS receives for each of the four notices it issues to taxpayers whose debts are not assigned to PCAs.

I question whether, in light of actual taxpayer behavior, it makes good business sense to treat the same taxpayer’s liabilities differently for purposes of assigning them to PCAs. If the amount of the taxpayer’s recent debt ($5,000 in the example) is less than the older debt that was already assigned to a PCA, the taxpayer might be able to pay the recent tax debt while it is still in the notice stream, which would mean the IRS would not have to pay a commission to a PCA. Moreover, the new $5,000 liability in the example is self-assessed, not the result of an audit or other assessment process. As a recent TAS study demonstrated, the IRS is more likely to collect self-reported liabilities than other types of assessments. For example, it collects self-assessed liabilities at a rate at least twice as great as it collects audit assessments.

So, by bypassing the notice stream, the IRS:

The IRS, however, benefits from this approach because it retains 25 percent of the amount PCAs collect. Thus, the PCAs and IRS benefit from this truncated procedure while the public fisc, on the other hand, does not.

Read more about the NTA’s Private Debt Collection blog series: