Is your organization interested in applying for a Low Income Taxpayer Clinic (LITC) Program matching grant? This is a great opportunity for an organization not currently receiving an LITC grant to apply for funding. The supplemental application period opened March 15, 2021, and will close on April 16, 2021.

Generally, organizations interested in an LITC grant must apply for funding each year, but those selected during this supplemental application period will receive a grant that will cover an 18-month period from July 1, 2021, through December 31, 2022. Grant funds can be awarded for startup activities. All supplemental applications must be filed electronically by 11:59 p.m. (ET) on April 16, 2021, via Grants.gov.

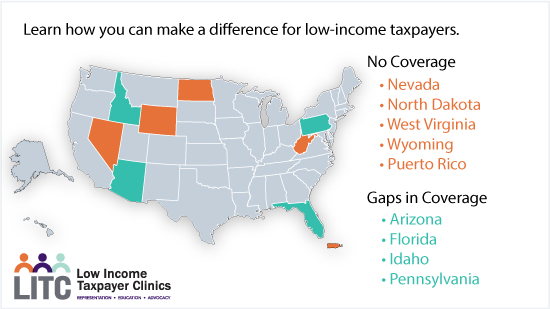

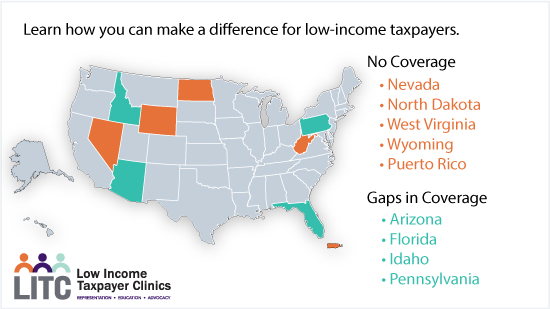

The IRS remains committed to achieving maximum access to representation for low-income taxpayers. It strives to have sufficient clinic coverage in each state, the District of Columbia, and Puerto Rico, and expanded clinic coverage in areas that are underserved. However, some areas have no clinics or have gaps in coverage. Consequently, priority consideration will be given to qualified applicants who can provide services in currently underserved areas. At present, Nevada, North Dakota, West Virginia, Wyoming, and the U.S. territory of Puerto Rico do not have an LITC. Several states – Arizona, Florida, Idaho, and Pennsylvania – have coverage gaps.

Anyone can join the LITC staff for a Zoom webinar on March 18 at 1 p.m. for more information about the LITC Program and the application process.

Information about program participation requirements, standards for operating an LITC, and how to apply are available in this video and Publication 3319, LITC Grant Application Package and Guidelines (PDF). Be sure to note actions that should be initiated before applying. Publication 4134, Low Income Taxpayer Clinic List, provides location and contact information for current LITCs and the languages in which each offers services. Of the 129 LITCs presently funded, 66 are with legal services organizations, 41 are at academic institutions, 17 are part of community-based nonprofit organizations, and five are sponsored by bar associations or are pro bono volunteer-focused organizations. For more information and success stories about the impact LITCs have on the lives of low-income and English as a second language taxpayers, see Publication 5066.

If you or potential applicants have questions or need additional information about the LITC Program or the grant application process, please contact the LITC Program Office at 202-317-4700 (not a toll-free call) or by email at LITCProgramOffice@irs.gov.

A separate application period for the 2022 grant year will open on May 3, 2021.