Many individuals may not know they can request, receive, and review their tax records via a tax transcript from the IRS at no charge. Part I explained how transcripts are often used to validate income and tax filing status for mortgage applications, student loans, social services, and small business loan applications and for responding to an IRS notice, filing an amended return, or obtaining a lien release. Transcripts can also be useful to taxpayers when preparing and filing tax returns by verifying estimated tax payments, Advance Child Tax Credits, Economic Income Payments/stimulus payments, and/or an overpayment from a prior year return.

While IRS transcripts can be helpful, reading and understanding them can be complicated. The IRS’s processing system, the Integrated Data Retrieval System (IDRS), uses a system of codes to identify a transaction the IRS is processing and to maintain a history of actions posted to a taxpayer’s account. These Transaction Codes (TCs) basically provide processing instructions to the IRS’s system. To make IRS transcripts user-friendly for the public, the IRS provides a literal description of each TC shown on a taxpayer’s IRS transcript. Although helpful, sometimes these descriptions don’t adequately explain the account transaction. Document 11734, Transaction Code Pocket Guide (Obsolete), is a summarized list of TCs taken from section 8A of the IRS’s Document 6209, ADP and IDRS Information Reference Guide, both of which may be helpful when reviewing an IRS transcript.

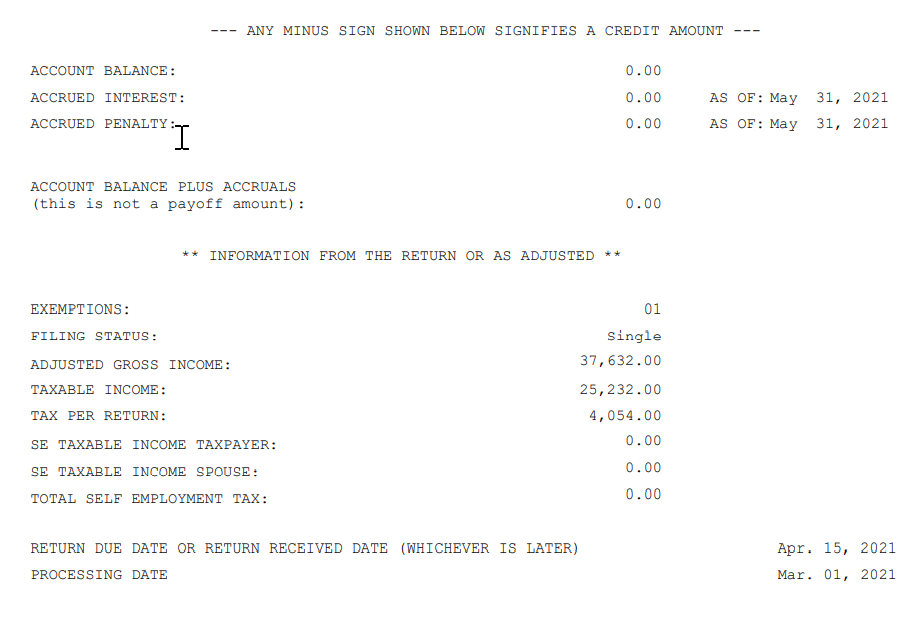

As shown in the fictitious example below, the Record of Account Transcript will summarize any balance due or overpayment on a taxpayer’s account for the specified year at the top of the form. If the account reflects a balance due, the transcript provides the date to which any accrued penalty and interest were calculated. Next, the transcript will show specific information from the taxpayer’s return – or the corrected amounts resulting from any changes to the return caused by either a request from the taxpayer or an IRS determination. This is noteworthy should a taxpayer find it necessary to file an amended return. The correct figures must be used as the starting point on Form 1040X, Amended US Individual Income Tax Return, when requesting any subsequent account adjustments – otherwise, processing problems may occur.

Figure 1

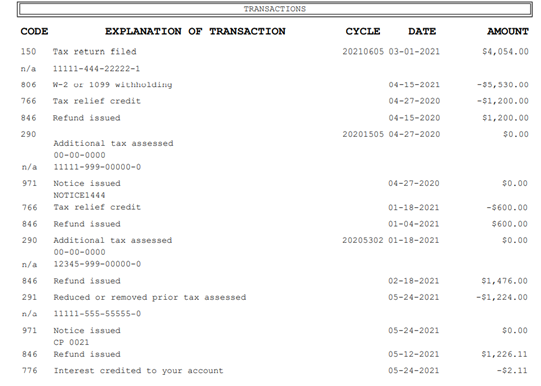

This section of the Record of Accounts Transcript provides details regarding the taxpayer’s account activity, as shown in Figure 2.

Figure 2

Some of the common TCs on the tax account portion of a transcript are:

In the above example, tax credits, withholding credits, credits for interest the IRS owes to a taxpayer, and tax adjustments that reduce the amount of tax owed, are shown as negative amounts on the tax account transcript. In other words, negative amounts on an IRS transcript can be considered amounts “in the taxpayer’s favor.”

Because TCs on a taxpayer’s account are essentially instructions to the IRS system, it is important to note that some TCs are input for informational reasons not directly associated with an accounting-related dollar amount.

I hope we have not confused you. Using the IRS’s Pocket Guide should help you understand the transcript and provide you with the key information you are seeking.

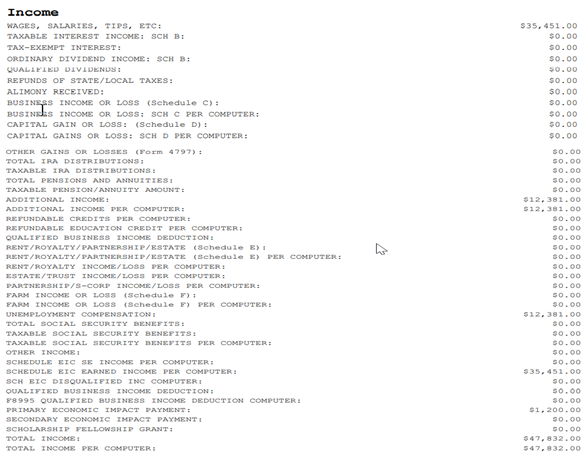

The tax return portion of the Record of Accounts depicts most of the line entries on the taxpayer’s tax return when it was filed. Figure 3 provides only the income section of our fictitious example; however, the actual Record of Accounts will depict all the sections of a taxpayer’s filed tax return and can be useful when the taxpayer has not maintained a copy of his or her return and needs to know what was reported to the IRS on his or her return.

Figure 3

In July 2021, IRS updated a webpage on IRS.gov to educate taxpayers regarding the new transcript format and use of the “customer file number,” which was designed to better protect taxpayer data. This new format partially masks personally identifiable information. However, financial data will remain visible to allow for tax return preparation, tax representation, or income verification. These changes apply to transcripts for both individual and business taxpayers.

Here’s what is visible on the new tax transcript format:

For security reasons, the IRS no longer offers fax service for most transcript types to both taxpayers and third parties and has stopped its third-party mailing service via Forms 4506, 4506-T, and 4506T-EZ.

Lenders and others who use the Forms 4506 series to obtain transcripts for income verification purposes should consider other options such as participating in the Income Verification Express Service or having the customer provide the transcript.

Only individual taxpayers may use Get Transcript Online or Get Transcript by Mail. Because the full Taxpayer Identification Number is no longer visible, the IRS created an entry for a Customer File Number. The Customer File Number is a ten-digit number assigned by the third-party, for example, a loan number that can be manually entered when the taxpayer completes his or her Get Transcript Online or Get Transcript by Mail request. This Customer File Number will then display on the transcript when it is downloaded or mailed to the taxpayer. The transcript’s Customer File Number serves as a tracking number that enables a lender or other third party to match the transcript to the taxpayer making the transcript request.

Taxpayers needing tax return, tax account, or information return information may quickly find what they need through the IRS’s Get Transcript Online portal or their online account. I continue to urge the IRS to expand the Online Account functionality and increase its availability to practitioners and businesses. The current functionalities provide many basic and helpful information, and I look forward to continued expansion of functionality. Transcripts are free and provide a wealth of information. I encourage taxpayers to explore this option. If an IRS transcript can meet a taxpayer’s needs, it may be preferable to trying to contact the IRS or other more time-consuming methods of requesting tax account information.

The views expressed in this blog are solely those of the National Taxpayer Advocate. The National Taxpayer Advocate presents an independent taxpayer perspective that does not necessarily reflect the position of the IRS, the Treasury Department, or the Office of Management and Budget. NTA Blog posts are generally not updated after publication. Posts are accurate as of the original publication date.