Part I of this two-part blog discussed how to identify penalty relief associated with the IRS’s recently announced broad penalty relief initiative on IRS tax account transcripts and explained the many uses of the transcript transaction code (TC) 290. Part Two continues with more helpful tips I hope you will find useful when trying to understand IRS transcripts.

What Are “Cycle Dates” and “Transaction Dates,” and Why Are They Important?

A transaction date is the effective date of a transaction on a tax account, and the cycle date represents the date the IRS processed the transaction. Sometimes these dates coincide, and sometimes they do not. Have you ever looked at a tax account transcript and wondered for example, “Why did the IRS send a bill dated June 1 when the payment made on April 30 is right there on the account?” To find the explanation, you may need to look at the cycle date of the payment transaction, if available, rather than the transaction date. Because the IDRS system generally uses transaction dates for the automated computation of penalties and interest, it is very important that certain transactions, such as the receipt of a tax return, a credit, or a payment of tax, carry the correct transaction date – though the processing of the transaction may occur much later. Though the account transcript may now reflect the April 30 payment, the cycle date might show that the April 30 payment wasn’t processed or “posted” to the tax account until after the June 1 notice was issued.

Though transaction dates are very important, there can be times when cycle dates are equally important. For instance, consider the situation that occurs when an overpayment is applied toward a liability on another account. Though the transaction date (the date of the credit for interest and penalty computation purposes) might be substantially earlier, the cycle date of the application of the overpayment would be the most appropriate date when determining when a tax was paid. Per Internal Revenue Manual (IRM) 25.6.1.7.2(5), an overpayment credited to an underpayment of another year or to another type of tax constitutes a payment on the date the credit is allowed. In this situation, the cycle date is usually the most appropriate date for determining when the tax was paid for purposes of the two-year rule associated with claims for refund.

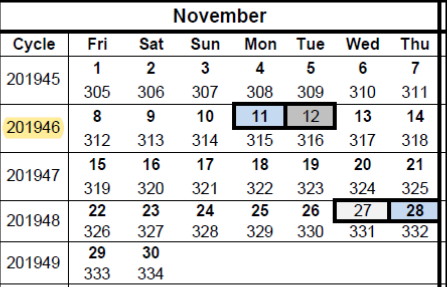

Though cycle dates can provide useful information, cycle dates are not always present on external transcripts, and when they are, they can be confusing for taxpayers to understand. The payments below appear as they would appear on an IRS internal use transcript – inclusive of the cycle date. The cycle date, as highlighted below, is comprised of the cycle year (2019), the cycle week (week 46 of year 2019), and the day of the cycle week (day 5). Note: After January 1, 2012, the cycle week runs from Friday through Thursday as shown later, such that Friday is day 01, skipping Saturday and Sunday, such that Monday is day 02, etc.

706 10202017 $500.00- 20194605

706 11182017 $500.00- 20194605

Though these payments are dated October 20, 2017, and November 18, 2017 respectively, the 2019 Posting Cycles chart (available in section 16 of IRS’s Document 6209, ADP and IDRS Information Reference Guide), reflects that these payments were actually applied to the account on November 14, 2019 – a significant time difference when considering the refund statute of limitation triggered by the date the payments were applied.

2019 Posting Cycles

Transcripts the IRS provides to the public do not consistently provide cycle dates. In fact, the same payment transactions discussed above would appear on an external transcript as shown below, possibly providing the erroneous perception that the statute had expired for refund of these payments.

706 Credit transferred in from 10-20-2017 -$500.00

1040 201412

706 Credit transferred in from 11-18-2017 -$500.00

1040 201412

To provide taxpayers and representatives with the most complete information possible, I am advocating for the inclusion of cycle dates for all transcript transactions, or better yet, the conversion of the cycle date to a traditional date that would be reflected on the transcript as the “processing date” for improved clarity.

Why Doesn’t the Tax Account Information on My Transcript Match My Records?

The Record of Accounts Transcript will show specific information from a tax return – or the corrected amounts resulting from any changes to the return caused by either a request from the taxpayer or an IRS determination.

** INFORMATION FROM THE RETURN OR AS ADJUSTED **

| EXEMPTIONS: | 03 |

| FILING STATUS: | Single |

| ADJUSTED GROSS INCOME: | 11.00 |

| TAXABLE INCOME: | 11.00 |

| TAX PER RETURN: | 11.00 |

| SE TAXABLE INCOME TAXPAYER: | 0.00 |

| SE TAXABLE INCOME SPOUSE: | 0.00 |

| TOTAL SELF EMPLOYMENT TAX: | 0.00 |

This is noteworthy should a taxpayer find it necessary to file an amended return. The IRS’s figures must be used as the starting point on Form 1040-X, Amended U.S. Individual Income Tax Return, when requesting any subsequent account adjustments – otherwise, processing problems may occur.

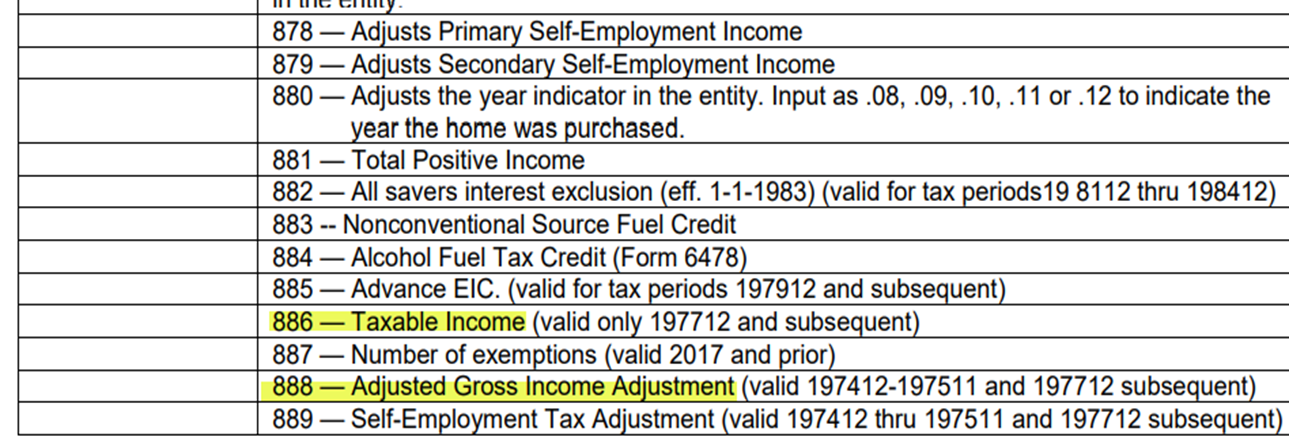

If the tax account transcript reflects an adjustment to tax, you may find that the adjusted gross income, taxable income, or other items shown on the transcript no longer reconcile. If this occurs, it is likely the result of the way a prior tax adjustment was input into the IRS’s system. When an IRS employee makes an adjustment to tax, he or she will typically enter corresponding credit reference numbers (from section 8C of Document 6209, as shown below), to tell the IDRS system the type and the amount of the return items being adjusted to create the associated tax adjustment. The IDRS system, however, will accept many account adjustments with or without these codes, resulting in situations where the adjusted gross income, taxable income, or other items, if not appropriately adjusted along with the tax, no longer reconcile to the amount of tax shown on the transcript. When filing Form 1040-X, use the numbers from the IRS transcript to complete column A, specifically ensuring that the tax matches the tax as computed from the IRS transcript transactions. By entering the correct amounts in column C and placing the difference in column B, the IRS should ensure that all necessary adjustments are made to bring the tax and the corresponding return items back to the appropriate and correct amounts when processing the amended return.

Example of Valid Credit Reference Numbers

Why Am I Receiving a Bill When My Transcript Indicates the Account Balance Has Been Written Off?

IRM 21.6.8.2 discusses situations that will create a split account. Some of the most common reasons include bankruptcy, offer in compromise, and innocent spouse; however, this can also occur for other reasons – one spouse appeals or petitions an examination adjustment while the other does not, one spouse is determined to be “currently not collectible” while the other is not, etc. When tax assessments are split or mirrored, the liability will be removed from the joint tax account and the appropriate liability amounts will be placed on separate (MFT 31) accounts under each spouse’s taxpayer identification number. Similarly, this can also occur for shared responsibility payments when necessary.

Sometimes these accounts are simply split, allowing the IRS to pursue collection of the appropriate amount from each spouse – other times the accounts are “mirrored,” which allows the IRS to separately pursue collection from either spouse. The mirroring process is in place to prevent the IRS from unintentionally overcollecting when both spouses are responsible for the same tax liability on these separately created accounts.

Unfortunately, split/mirrored accounts can cause confusion for external transcript users. This is because the joint account often reflects the narrative explanation “write off balance due,” as shown below. To add to the confusion, these separate accounts are not available for viewing or retrieval via the IRS’s external transcript systems. Taxpayers and representatives may be unaware that split/mirrored accounts exist, hindering correct and appropriate account resolution activities. I am currently advocating for the IRS to make these tax account transcripts available for retrieval and/or alter the TC 604 explanation to more appropriately explain this account activity, alerting transcript recipients that another account exists. Currently, the best method for determining if another account exists is to look for a TC 971, which contains a narrative explanation concerning the transfer of the liability. In these instances, you will need to contact the IRS to secure information regarding these separately created accounts. Accounts that have in fact been written off will not contain a TC 971 referencing a balance transfer.

400 Transfer account out 12-08-2021 -$10,000.00

402 Transfer account in 12-08-2021 $10,000.00

971 Balance transferred to split liability account 12-22-2021 $0.00

604 Write-off of balance due 12-22-2021 -$10,000.00

Conclusion

Although I’ve discussed a few of the items that might lead to confusion, I’m sure there are a host of others. Many questions can be answered using the IRS’s Document 6209, ADP and IDRS Information Reference Guide. TAS continues to work with the IRS to improve transcript quality and to make transcripts more user-friendly for IRS customers. You can help by giving us your feedback. Any concerns or recommendations to improve transcript products can be forwarded to us through our Systemic Advocacy Management System (SAMS).

Eligible taxpayers can reach out to Low Income Taxpayer Clinics (LITCs) for assistance. LITCs are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs are a great resource and can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court, including the Tax Court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. LITCs must not charge more than a nominal fee for their services. For more information or to find an LITC near you, visit www.taxpayeradvocate.irs.gov/litc or see IRS Publication 4134, Low Income Taxpayer Clinic List. This publication is also available online at www.irs.gov/forms-pubs or by calling the IRS toll-free at 800-TAX-FORM (800-829-3676).

Note: To comply with IRC § 6103, which generally requires the IRS to keep taxpayers’ returns and return information confidential, the transcripts included in this blog are fictional.

The views expressed in this blog are solely those of the National Taxpayer Advocate. The National Taxpayer Advocate presents an independent taxpayer perspective that does not necessarily reflect the position of the IRS, the Treasury Department, or the Office of Management and Budget. NTA Blog posts are generally not updated after publication. Posts are accurate as of the original publication date.